Red Sea rerouting causing Asian port congestion – Tái định tuyến trên Biển Đỏ gây tắc nghẽn cảng châu Á

The diversion of container ships from the Red Sea to the Cape of Good Hope has caused significant congestion at Asian ports. This re-routing, primarily driven by changing demands and unforeseen events, has necessitated constant adjustments in port calls and vessel sizes on Asia-Europe loops. This congestion is particularly noticeable at key ports like Jebel Ali and those in Southeast Asia.

- Congestion Build-Up: The diversion has led to fluctuating service configurations, resulting in congestion at certain ports due to unexpected events and higher volumes. This has placed additional pressure on infrastructure and inland operations, causing backlogs.

- Terminal Performance Impact: Off-window arrivals have adversely impacted terminal performance. Congestion hotspots have emerged, with the worst-affected markets experiencing fewer but longer mainline calls, indicating higher cargo exchange volumes.

- Jebel Ali Port Impact: At Jebel Ali, the dwell time for ships larger than 12,500 TEU increased from 1.5 days in Q4 2023 to 2.5 days in Q1 2024. Contributing factors include the size of ships, holidays like Eid al-Fitr and Ramadan, and recent floods in Dubai. Increased cargo volumes have also strained inland infrastructure, including trucking and container storage.

- Regional Congestion: Other ports in Southeast Asia, such as Singapore and Port Klang, have also experienced increased vessel waiting times. The Indian Subcontinent/Middle East and Southeast Asia regions account for 15% and 16% of global port congestion, respectively.

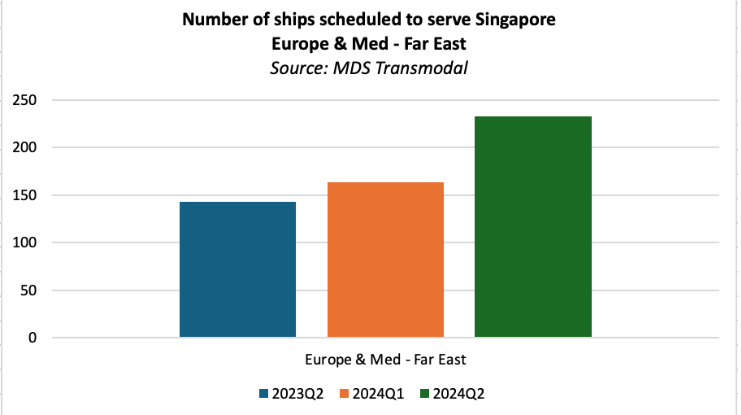

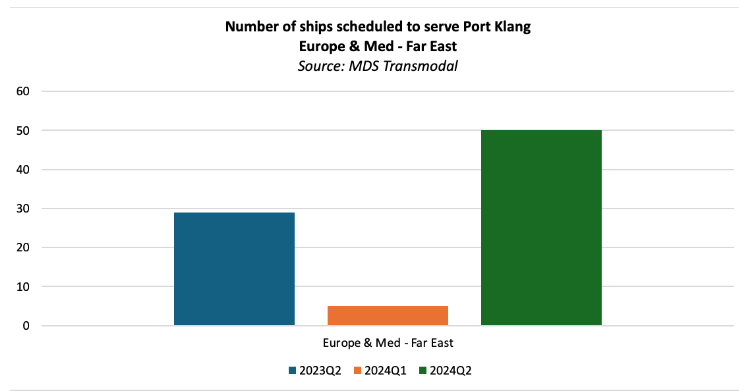

- Cargo Capacity Changes: According to MDS Transmodal, the number of vessels arriving in the Middle East from Southeast Asia remained stable until Q2 2024, when it surged significantly. Port Klang saw a particularly volatile capacity, with vessel numbers fluctuating drastically.

- Capacity Increase on Major Trade Lanes: Cargo capacity on Asia-Europe trade lanes increased from 3.5 million TEU in Q2 2023 to 4.5 million TEU in Q2 2024. However, capacity for wayport calls dropped by over 30% in Q2 2024. These constant changes have affected ports receiving cargo.

- Red Sea Diversions in Transition: Initial diversions saw ships loaded to discharge East Med cargo first, but now the loading direction has changed, resulting in fewer calls but larger exchanges and extended average dwell times.

- Potential Spread to European Ports: Although North European and Mediterranean ports have not yet experienced significant congestion, there are concerns that the current congestion in Asia will eventually impact Europe. The increased deployment of larger vessels and the need for quick returns to Asia add pressure on hub ports and could lead to congestion spreading to Europe.

In conclusion, the diversion of ships around the Cape of Good Hope has led to substantial congestion in Asian ports, particularly in the Middle East and Southeast Asia. This has resulted in longer dwell times, strained inland infrastructure, and fluctuating cargo capacities. The situation remains dynamic, with potential implications for European ports in the near future.

🚢 Port Call Reconfiguration: Container ships are being rerouted via the Cape of Good Hope, leading to continuous changes in port calls and vessel sizes.

🌏 Congestion Build-Up: Ports are experiencing congestion due to fluctuating service configurations and increased volumes.

🛑 Terminal Performance: Off-window arrivals adversely impact terminal performance, especially at major ports in the Red Sea and Asia.

📦 Higher Cargo Exchange: Mainline calls are fewer but each call takes longer due to higher cargo exchange, as carriers consolidate cargo onto fewer services.

⚓ Increased Dwell Time: The dwell time at Jebel Ali for ships larger than 12,500 TEU increased from 1.5 days in Q4 2023 to 2.5 days in Q1 2024.

🌿 Holiday and Weather Impact: Holidays like Eid al-Fitr and Ramadan, as well as recent floods in Dubai, have added to congestion levels.

🚛 Inland Infrastructure Challenges: Increased cargo discharge is challenging inland port infrastructure, including trucking and container storage.

📈 Southeast Asian Ports: Ports like Singapore and Port Klang have recorded increased vessel waiting times in recent weeks.

🔄 Volatile Ship Numbers: The number of ships handled by Singapore increased from 160 in Q1 to about 260 in Q2 2024, with Port Klang experiencing similar fluctuations.

⚠️ Logistical Implications: Vessel reconfigurations mean cargo is often not where it was intended, requiring extra effort to get it to its destination.

📉 Capacity Changes: Cargo capacity from Asia to Europe increased from 3.5 million TEU in Q2 2023 to 4.5 million TEU in Q1 2024, then dropped by 30% to just under 2 million TEU in Q2 2024.

🌍 Potential European Impact: There is concern that the emergent congestion in Asia will eventually spread to European ports.

🔄 Route Peaking Factors: Fewer calls, larger exchanges, and route peaking factors have extended average dwell times and increased pressure on ports.